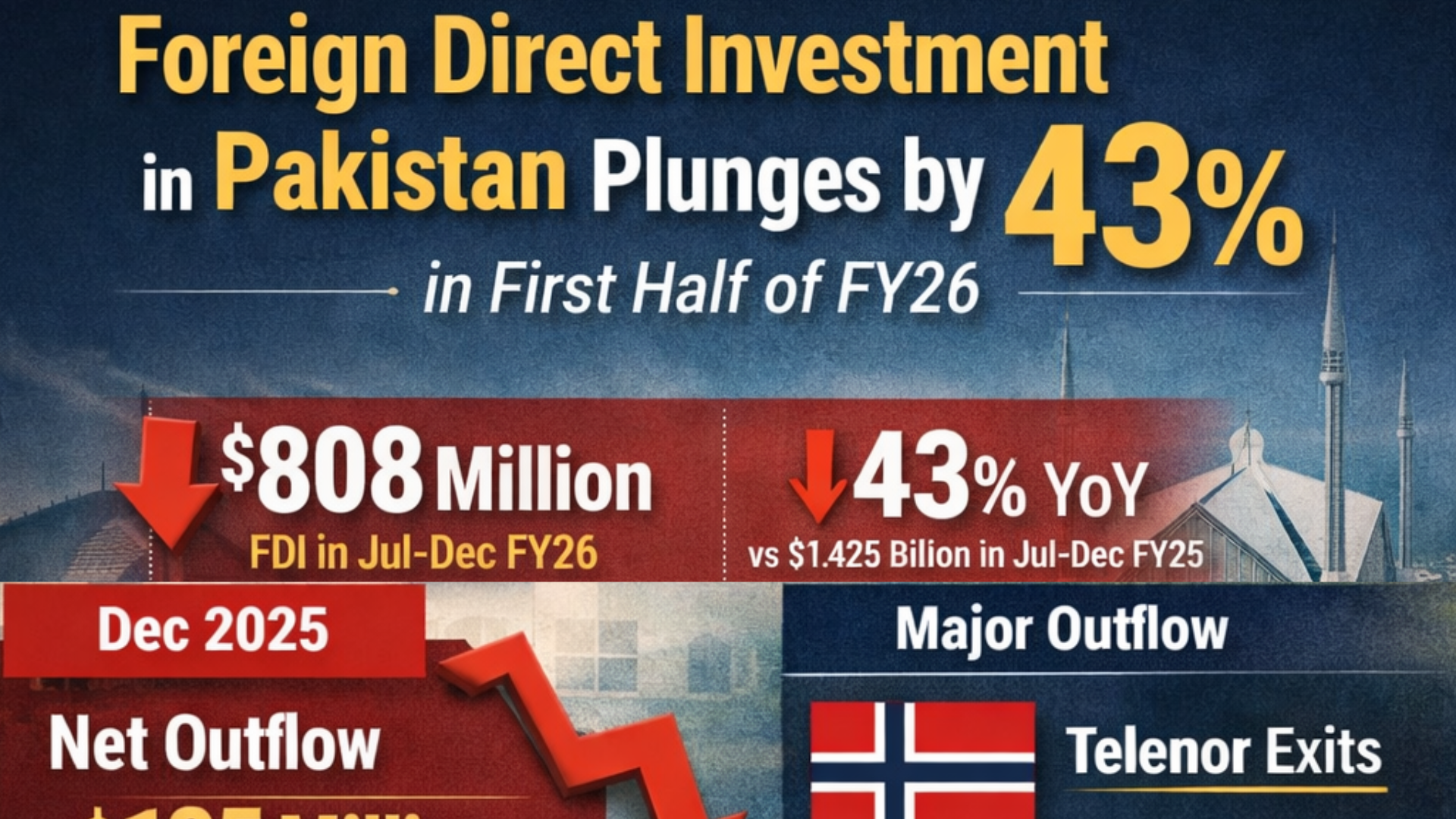

Foreign Direct Investment in Pakistan Falls 43% in First Half of FY26. Foreign Direct Investment in Pakistan recorded a sharp decline during the first half of fiscal year 2025–26. Latest official data shows growing investor caution, sector-specific exits, and continued pressure on capital inflows despite ongoing economic reforms.

FDI in Pakistan Drops 43% Year-on-Year

According to data released by State Bank of Pakistan, Pakistan’s net Foreign Direct Investment (FDI) stood at $808 million during the first six months of FY26.

This marks a 43% year-on-year decline compared to $1.425 billion recorded during the same period of the previous fiscal year.

The drop reflects weakening investor confidence, large capital exits, and slower inflows across key sectors of the economy.

December 2025 Sees Net FDI Outflow

The situation worsened in December 2025, when Pakistan recorded a net FDI outflow of $135 million.

This contrasts sharply with November 2025, which had posted a net inflow of $180 million.

Such month-to-month volatility highlights how sensitive foreign investment remains to policy clarity, sector stability, and corporate decisions.

Norway Leads Major FDI Outflow

The largest net outflow during the period came from Norway, totaling $376 million, mainly from the IT and telecom sector.

According to market analysis shared by Topline Securities, the outflow was linked to the exit of Telenor from Pakistan.

Telenor sold its local operations to PTCL, triggering a large repatriation of capital and contributing significantly to the overall FDI decline.

Why Telenor’s Exit Matters

Telenor’s departure is important for three reasons:

First, it was one of the largest foreign investors in Pakistan’s telecom sector.

Second, the telecom and IT sector traditionally attracts long-term foreign capital.

Third, large exits often send negative signals to other potential investors.

Although the PTCL acquisition keeps assets within the country, the foreign capital exit still impacts net FDI figures.

Sector-Wise Impact on Foreign Investment

While telecom and IT recorded the largest outflow, other sectors also saw slower inflows, including:

- Financial services

- Energy and power

- Manufacturing

- Infrastructure-related projects

Investors remain cautious due to currency volatility, import restrictions, and uncertainty around long-term economic stability.

Key Reasons Behind the FDI Decline

Several factors contributed to the sharp fall in Foreign Direct Investment in Pakistan:

1. Corporate Exits

Large multinational exits, especially in telecom, heavily affected net FDI numbers.

2. Economic Uncertainty

Inflation pressure, exchange rate adjustments, and fiscal tightening reduced investor risk appetite.

3. Policy Consistency Concerns

Frequent changes in regulations and taxes discouraged long-term commitments.

4. Global Investment Slowdown

Worldwide tighter financial conditions also reduced capital flows to emerging markets.

Despite Decline, FY26 FDI Outlook Remains Positive

Despite the weak first-half performance, Topline Securities expects total FDI for FY26 to reach around $2.5 billion.

This projection is based on:

- Improved macroeconomic indicators

- IMF-backed reforms

- Potential inflows in energy, mining, and IT

- Stabilization of the exchange rate

However, achieving this target will require strong investor confidence and consistent policy execution.

How FDI Impacts Pakistan Economy

Foreign Direct Investment plays a critical role in Pakistan’s economy by:

- Creating jobs

- Supporting foreign exchange reserves

- Improving technology transfer

- Boosting exports

- Reducing reliance on external debt

A sustained decline in FDI can slow economic growth and increase pressure on the balance of payments.

What Pakistan Needs to Attract More FDI

To reverse the declining trend, experts suggest Pakistan should focus on:

- Long-term policy stability

- Transparent regulatory frameworks

- Faster approvals for foreign investors

- Sector-specific incentives

- Protection of investor rights

Restoring trust is more important than offering short-term incentives.

Conclusion

Foreign Direct Investment in Pakistan fell 43% in the first half of FY26, driven mainly by large corporate exits and cautious investor sentiment. The $808 million inflow reflects structural challenges rather than a single-month issue.

While projections of $2.5 billion FDI for FY26 offer hope, Pakistan must deliver consistency, stability, and investor-friendly policies to turn expectations into reality. The coming months will be crucial in determining whether Pakistan can regain foreign investor confidence or continue to face capital outflows.